Selling a Home with Fire Damage: We Buy Houses With Fire Damage in Westminster, CO

Sell a fire damaged house fast we'll pay cash in Westminster and all the surrounding suburbs like Broomfield, Thornton, Arvada, Northglenn

AS-IS FAIR CASH OFFER

IN 5 MIN OR LESS

Free Offer Form

We Offer The Most Cash

Close Within 7-21 Days

We Asses All The Damage

Professional & Reliable Team

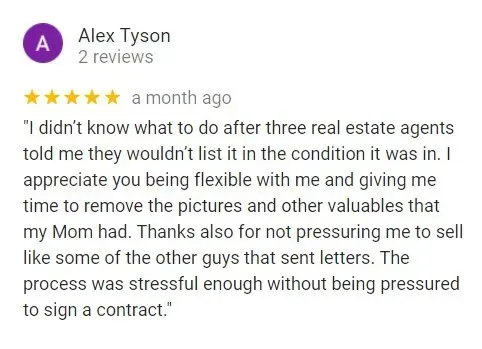

RECENT REVIEWS

HOW IT WORKS

WHY SELL TO US?

WE DEAL CASH

If you have a fire damaged house, we will pay you cash, no matter what condition it is in. We are prepared to give you a fair and honest offer for your fire damaged home. Selling a House with Fire Damage will purchase on an as-in cash basis as per terms agreed with the home seller.

TOP FIRE DAMAGED CASH BUYER

It’s rare to find investors who are willing to buy a burned-out house, but we are. We specialize in buying fire-damaged houses in every major metro in the United States.

FIRE DAMAGE EXPERTS

With our extensive background in fire damages and fire restoration, we have become the most trusted name in our industry. With our free consultation, we’ll guide and assist you throughout the process. Get in touch with an expert today.

Selling a House with Fire Damage is all about satisfying the customer every single step of the way. It started with the very talented office staff, and continued with the crew that actually completed the work on my home. Highly Recommended!

Nick Enfaso, Sold Home to Selling a House with Fire Damage

How to Sell a Fire-Damaged Property Fast & For More in Westminster

After the fire is out, the questions begin. You're not just dealing with the emotional toll, but a complex financial puzzle that demands fast, smart decisions.

The good news is that a clear path forward exists. Selling a fire-damaged home in Westminster may seem complex, but there are proven strategies to expedite the entire process. It starts with immediate, critical actions like securing the property and getting the official fire department report. We understand you need a concrete plan, not just sympathy.

Soon, you’ll face a pivotal choice. You can either manage a full repair before listing or sell the property "as-is" to a cash buyer in Westminster, which is often the fastest route to a closed deal.

Making that call confidently requires a professional damage assessment and a pricing strategy that reflects the home’s true value. It also means knowing how to find the right buyers who specialize in these unique properties.

Understanding the legal disclosure requirements is the final piece to prevent setbacks and protect your sale. This is your roadmap for turning a difficult situation into a successful outcome.

Immediate Post-Fire Actions That Accelerate Your Sale Timeline

In the overwhelming hours after a fire, your actions can directly influence how quickly you can sell your property in Westminster. It’s about methodically taking control of a chaotic situation.

These first moves aren't just about damage control. They are the foundation for protecting your asset’s value, streamlining an insurance claim, and setting the stage for a successful sale.

Securing And Protecting Your Property From Further Damage

Your first priority is always safety. Do not re-enter the property until the fire department has officially declared it safe to do so.

Once you have clearance, the immediate task is to protect the home from any further harm. This prevents unauthorized entry, which could lead to vandalism or liability issues if someone gets hurt. Here’s what that typically involves:

- Boarding up: Hire a professional service to board up all accessible windows, doors, and other openings.

- Temporary fencing: In some cases, you may need to install fencing around the property's perimeter for added security.

This isn't just about keeping people out. It also protects the interior from weather damage, which can quickly compound the initial problem. A secured property shows both your insurance company and future buyers that you are a responsible owner, even in a crisis.

Documenting Everything For Future Buyers And Legal Protection

Before a single item is moved or cleaned, it's time to create a detailed record. This is one of the most powerful steps you can take to support your insurance claim and future sale.

Think of your smartphone as your most important tool right now. Take extensive photos and videos of everything, capturing damage from multiple angles—from wide shots of rooms to close-ups of specific items.

Beyond your own documentation, you need one crucial piece of paper: The Official Fire Report. Obtain a copy from the local fire department. This document is non-negotiable for your insurer and provides an objective, third-party account of the incident that builds trust with potential buyers.

Coordinating With Insurance Adjusters To Maximize Your Position

As soon as you are able, it’s time to make two critical phone calls. The sooner you start this process, the sooner you'll understand your financial standing.

- Your Homeowner's Insurance Provider: Report the loss to officially begin the claims process. This gets an adjuster assigned to your case right away.

- Your Mortgage Lender: Your lender has a significant financial interest in the property. Keeping them informed is essential for a smooth process, as they are often a party to the insurance claim.

Clear, prompt communication here is the key to unlocking your options for selling.

Establishing Temporary Safety Measures And Utility Management

To prevent further hazards, you must arrange for all utilities to be professionally shut off at the source. Firefighting efforts can leave behind massive amounts of water, and a compromised electrical system is a serious risk. Contact your local utility companies to disconnect these services:

- Gas: Prevents dangerous leaks from damaged lines.

- Electricity: Avoids the risk of electrical shorts or fires in a water-damaged system.

- Water: Stops the potential for burst pipes, which can cause devastating secondary damage, especially in freezing weather.

This simple step protects the property from compounding problems and demonstrates due diligence to everyone involved in the sale.

Comprehensive Damage Assessment Strategies For Quick Decision Making

Once the property is secure, your next move is to understand exactly what you're dealing with. A quick visual inspection simply won’t be enough.

To make a fast, confident decision about selling, you need a comprehensive, professional understanding of the damage—both what you can see and what you can't. This assessment is the single most important tool you'll have. It’s the foundation for your insurance claim, your pricing strategy, and your negotiations.

Professional Inspection Services That Buyers Trust

Here's the thing: a serious buyer needs more than an opinion. They need credible data from licensed experts to feel confident. Assembling the right team is the first step. We recommend starting with these key professionals:

- A Structural Engineer: This one is non-negotiable. Intense heat, often exceeding 1,200°F, can compromise concrete foundations, warp steel beams, and weaken wooden trusses. An engineer’s report is the only document that officially confirms the home's structural integrity, and no savvy buyer will move forward without it.

- A Fire Damage Restoration Contractor: These specialists provide a detailed, line-item estimate for the entire restoration, from debris removal to the final coat of paint. For cash investors, this document is gold because it gives them a clear scope of work and a realistic budget from day one.

An Industrial Hygienist: This might sound extreme, but it's a critical safety check if the home was built before the 1980s. A fire can release hidden dangers like asbestos fibers and lead dust into the air. This report is essential for proper disclosure and for planning a safe remediation process.

Identifying Hidden Damage That Could Derail Your Sale

The real trouble with fire damage isn't always the charred wood. It’s the problems that lurk beneath the surface, waiting to become deal-breakers months down the line.

First, there's the water damage from firefighting efforts. All that water soaks into drywall, insulation, and subflooring, creating a perfect breeding ground for mold, which can start growing in as little as 24-48 hours.

Then there's the smoke and soot. It’s not just an unpleasant smell; acidic soot particles can permanently etch glass and tarnish metal fixtures. The odor itself can permeate so extensively into porous materials like wood framing that it's nearly impossible to remove without professional intervention.

Ultimately, a home's key systems—electrical, plumbing, and HVAC—are almost always compromised by the brutal combination of heat, smoke, and water, often requiring a full replacement.

Categorizing Damage Severity To Determine Your Best Selling Path

With professional reports in hand, the guesswork is over. You can now make an informed, strategic decision based on where your property falls. The findings will generally place your home into one of three categories:

- Minor to Moderate Damage: The fire was contained to a specific area, and the home's structural integrity is fully intact. In this case, repairing the home before selling might be a viable and profitable option.

- Significant Damage: The structure is sound, but the home requires a complete gut renovation to be livable. This is a prime candidate for an "as-is" sale to an investor or a professional flipper.

- Catastrophic Damage: The structural engineer has deemed the home unsafe or a total loss. What this means for you is that the property's value is now primarily in the land itself, making demolition and selling the lot the most likely path.

Knowing which category your property is in allows you to focus your energy on the most effective sales strategy right from the start.

Creating A Damage Portfolio That Builds Buyer Confidence

The final step in this phase is to compile all your documentation into a single, detailed package. This "damage portfolio" becomes your most powerful sales tool. It should include the following key documents:

- The official fire department report.

- All photos and videos you took immediately after the fire.

- The full, signed report from the structural engineer.

- The line-item repair estimate from the restoration contractor.

- Any reports on hazardous materials from the industrial hygienist.

Presenting this portfolio to a potential buyer shows you are transparent, organized, and serious. It answers their biggest questions before they even have to ask, replacing uncertainty with clear data and empowering them to make a fast, confident offer.

Strategic Decision Framework: Repair Versus As-Is Sale Analysis

With a clear picture of the damage, you've reached a critical decision point. This is where you map out the strategy for your sale.

Do you invest the time and money to repair the property for a traditional sale? Or do you opt for a fast, "as-is" sale? There isn't a single right answer, but there is a right answer for

your specific situation. The best path forward depends on a straightforward analysis of costs, timelines, and your personal capacity for risk.

Calculating True Repair Costs Beyond Initial Estimates

The quote from your restoration contractor is an essential starting point, but it's rarely the final number. The true cost of a repair-and-sell strategy often hides expenses that aren't immediately obvious.

Here's the thing: major repairs often trigger building code updates. That wiring from 1995 that was perfectly fine before the fire? It might now require a complete overhaul to meet current electrical codes, adding thousands to your budget. To get a realistic financial picture, you must account for these potential hidden costs:

- Code Compliance: Unexpected electrical, plumbing, or structural upgrades required by local inspectors.

- Contingency Fund: A buffer of 10-20% of the total estimate for surprises that almost always pop up during renovations.

- Holding Costs: Monthly expenses like mortgage payments, taxes, and insurance while the property is being repaired.

Your goal is to reach the "After Repair Value" (ARV)—the price your home could sell for once fully restored. The key calculation is ensuring your total investment (insurance payout + out-of-pocket costs) is significantly less than the ARV.

Evaluating Time Investment Against Market Conditions

Money is only one part of the equation; your time is the other critical resource. A full fire restoration is not a weekend project.

Depending on the extent of the damage and contractor availability, the process can take anywhere from 6 to 18 months. That's a long time to be paying for a property you can't use or rent out.

What this means for you is a direct trade-off. Contrast that year-long repair timeline with an "as-is" sale to a cash buyer. These sales can often close in as little as 7 to 30 days. Because investors typically pay with cash, they bypass the lengthy mortgage approval process—a process that is often impossible for a severely damaged home anyway.

Assessing Your Financial Resources And Risk Tolerance

This is where the decision becomes deeply personal. Let's be honest: managing a major renovation is a full-time job under the best of circumstances, let alone after the trauma of a house fire.

You need to take a candid look at your own situation. Do you have the liquid cash to cover the insurance deductible and any repair costs that go over the settlement amount? Are you prepared for the stress of managing contractors, permits, and potential delays?

Selling "as-is" effectively transfers that entire burden to the buyer. You get a guaranteed sale price and a firm closing date, without the headaches. For many homeowners we work with, that certainty and peace of mind are worth more than the potential for a higher profit down the road.

Market Timing Considerations That Impact Your Decision

To summarize, assess the current real estate market conditions within your local neighborhood. In a hot seller's market, the potential ARV might be high enough to justify the risk of repairs.

With buyers competing for limited inventory, a fully renovated home could command a premium price. However, in a cooling or uncertain market, the opposite is true. The risk of home values dipping during your lengthy renovation period is very real. Imagine spending 12 months and $80,000 on repairs, only to find the market has softened.

In that scenario, locking in a guaranteed cash sale today might be the smartest financial move, protecting you from future volatility.

Identifying And Targeting The Right Buyer Categories For Speed

Once you’ve decided on an "as-is" sale, the next step is figuring out who will actually buy your property. Let's be clear: a fire-damaged home isn't for the average house hunter. The traditional buyer scrolling through Zillow is almost certainly not your audience.

You're looking for a specific kind of person or company that sees opportunity where others only see damage. Here's the thing: traditional mortgage lenders are very reluctant to finance a home with significant issues. This means your ideal buyer will almost always be a cash buyer, which is the single biggest factor in accelerating your sale.

Real Estate Investors Who Specialize In Fire-Damaged Properties

For a quick, clean sale, this is your prime audience. These aren't hobbyists; they are professionals whose entire business is built around transforming distressed properties. A house with fire damage doesn't scare them—in fact, it's exactly what they're looking for. They bring three critical things to the table:

- Experience: They can accurately assess the scope of work and estimate repair costs without weeks of inspections.

- Resources: They have a network of trusted contractors ready to start work immediately.

- Capital: They have the cash on hand to close the deal without waiting for a bank's approval.

Their whole model is built on efficiency, which is a huge advantage for you.

Cash Buying Companies And Their Evaluation Processes

Within the investor world, you'll find specialized "We Buy Houses in Westminster" companies. They offer what is often the most predictable and fastest path to selling your home in Westminster.

Their process is refreshingly straightforward. They calculate their offer based on a simple formula: the home's potential value after repairs (ARV), minus the cost of those repairs, minus their own profit margin.

What this means for you is a transparent, no-nonsense offer. While the price will be less than a fully renovated home's market value, it's a firm, cash offer that can often close in as little as 7 to 30 days. You are essentially trading a higher potential price for guaranteed speed and certainty.

Contractors And Flippers Seeking Project Opportunities

This group includes general contractors and experienced house flippers actively hunting for their next project. Their superpower is their hands-on expertise, which allows them to manage a large-scale renovation themselves.

These buyers are particularly interested in properties with "good bones"—meaning the foundation and structural frame are mostly intact. If the damage is catastrophic, however, the property may attract a different kind of professional: a developer. They often see value in the land itself, planning a complete teardown and a new build from scratch.

End-User Buyers With Renovation Experience And Vision

This is the smallest and typically slowest category of potential buyers. Occasionally, you might find a courageous individual or family with construction expertise who wants to build their dream home at a significant discount.

They may use specialized financing, like an FHA 203(k) loan, which bundles the purchase and renovation costs. While it's a possibility, relying on this buyer is not a strategy for a fast sale. The process is much longer than a cash sale for several key reasons:

- Their financing is complex and involves far more red tape.

- Their decision-making is more emotional and less business-driven.

- The overall timeline from offer to closing is significantly longer.

Pricing Strategies That Balance Speed With Maximum Return

Setting the right price for a fire-damaged home is the single most important step for a fast, successful sale. This isn't like pricing a typical property, where you can just check the neighbor's recent sale price.

Your pricing strategy must be a calculated decision that speaks directly to specialized buyers. Get it right, and you’ll attract serious offers almost immediately. Get it wrong, and the property could sit for months, costing you time and money.

The goal is to find that sweet spot between a quick closing and a fair return. What this means for you is thinking less like a traditional home seller and more like the investors you want to attract. They run on numbers, and your price needs to make their numbers work.

Comparative Market Analysis For Fire-Damaged Properties

A standard Comparative Market Analysis (CMA) from a real estate agent is a good starting point, but it's only half the story. It tells you what pristine homes are worth in the area, which establishes a crucial metric: the After Repair Value (ARV).

The ARV is the estimated value of your property after all fire damage has been fully repaired and restored. This number is the foundation for every calculation, but the real analysis begins by digging into the costs that separate your property's current state from its potential ARV.

Factoring Repair Costs Into Your Asking Price Formula

Here's where the math comes in, and it’s the exact formula every cash buyer and investor uses to evaluate a deal. To land on a realistic "as-is" price, you have to subtract the costs and risks an investor takes on from the potential reward (the ARV).

Many experienced investors use a guideline known as the "70% Rule" to quickly see if a project makes sense. Here’s the formula:

(ARV x 0.70) – Estimated Repair Costs = Maximum Offer Price.

Let's break that down. The 30% discount from the ARV isn't just profit; it covers a range of expenses for the buyer:

- Profit Margin: Their required return for taking on the project.

- Holding Costs: Expenses like taxes, insurance, and utilities during the renovation.

- Closing & Selling Costs: Fees they'll pay when they eventually sell the renovated home.

- Risk: A buffer for unexpected issues that often arise in fire restoration projects.

By running this calculation yourself, you can anticipate the offers you’re likely to receive and price the property strategically. For this to be accurate, you absolutely need detailed repair estimates from licensed contractors who specialize in fire restoration—a ballpark guess will lead you astray.

In a worst-case scenario where the structure is a total loss? The formula simplifies to land value minus the cost of demolition and debris removal.

Psychological Pricing Techniques That Attract Quick Offers

With a fire-damaged property, the most powerful psychological tool is a significant, data-backed discount. Pricing your home 30-50% below the ARV instantly signals a serious opportunity to investors and generates immediate interest.

This approach shows you understand the market and are motivated to make a deal. Pricing too high with the hope that someone will "see the potential" is the fastest way to be ignored in this niche. You can still use standard tactics like pricing at $99,000 instead of $100,000 to show up in more online searches, but the substantial markdown is what truly drives action.

Negotiation Flexibility That Closes Deals Faster

Think of your asking price as the starting point for a conversation, not the final word. Building some negotiating room into your price is smart, but be ready to justify your number with the professional repair estimates you've gathered.

The more data you bring to the table, the stronger your negotiating position. Here’s a powerful piece of the puzzle many sellers overlook: your insurance claim.

If you are keeping a substantial insurance settlement for repairs, it can give you the financial flexibility to accept a lower offer on the property itself. This is a key lever for closing a deal quickly and moving forward.

Legal Compliance And Disclosure Requirements That Prevent Delays in Westminster

Tackling the legal paperwork for a property sale can feel overwhelming. When selling a fire-damaged home in Westminster, however, getting it right is the foundation of a fast, successful transaction.

This isn't just about checking boxes. It’s about building trust with your buyer and protecting yourself from future liability. Here’s the thing: transparency is your most powerful tool. A buyer who knows exactly what they’re getting into is a buyer who will close without hesitation.

State-Specific Fire Damage Disclosure Laws And Requirements

In the eyes of the law, fire damage is a "material defect"—a significant issue that would likely influence a buyer's decision. Because of this, nearly every state requires sellers to disclose all known material defects.

It’s a common myth that selling a property "as-is" lets you off the hook. It doesn’t. An "as-is" sale simply refers to the home's physical condition, not your legal duty to be honest about its history.

Most states provide a standard property disclosure form with specific questions about past fires, floods, or structural problems. Your job is to answer every question truthfully and completely. Hiding or downplaying the damage can lead to serious consequences, including the buyer suing for damages or even demanding to reverse the sale entirely.

Insurance Documentation That Buyers Need To See

A serious buyer, especially an experienced investor, will want to review the complete paper trail from the fire. This isn't about being invasive; it's about performing professional due diligence. Having this documentation ready from day one shows you're an organized and trustworthy seller. We recommend preparing a file that includes:

- The official fire report from the fire department.

- A complete copy of the insurance claim you filed, including the adjuster's summary.

- All professional assessments, such as reports from a structural engineer or environmental tests for smoke and toxins.

- The detailed repair estimates you received from contractors.

This packet of information is essential for a buyer to understand the scope of the damage and, just as critically, to secure their own property insurance policy.

Building Code Compliance Issues That Affect Marketability

A fire often puts a property under the local municipality's microscope. You must disclose any official notices the city or county has issued.

These can include a condemnation order or a list of mandatory repairs needed to meet current building codes. Such notices directly impact the property's value and what a new owner can legally do with it.

If you already completed repairs before the sale, you need to provide copies of all permits and final inspection reports. This is non-negotiable proof that the work was done to code and won't become a headache for the next owner.

Title And Liability Considerations For Smooth Closing

Ultimately, all this documentation and disclosure work to achieve one goal: a smooth closing and the transfer of a clean title. When you share everything upfront, you eliminate the buyer's ability to back out late in the game by claiming they were unaware of an issue.

More importantly, you shield yourself from post-sale legal action. A buyer who acknowledges all disclosures in writing has very little legal ground to sue you later. Full transparency is the fastest and safest route to a finalized deal.

Accelerated Marketing And Closing Techniques For Rapid Results

With your paperwork organized, it’s time to take decisive action. Traditional real estate marketing simply moves too slowly for a fire-damaged property.

Here's the thing: waiting for a family to see the "potential" can take months. You need a focused approach that attracts serious buyers and gets you to the closing table fast. This is how you take control of the timeline.

Direct Marketing To Investor Networks And Cash Buyers

The single most effective strategy is to go straight to the professionals. We're talking about real estate investors and cash-buying companies who see opportunity where others see work. They aren't looking for a perfect home; they're looking for a project. This means the conversation is about numbers and logistics, not emotions. You can find these buyers by:

- Contacting local "We Buy Houses" companies.

- Reaching out to Real Estate Investment Associations (REIAs) in your area.

- Partnering with a real estate agent who specializes in investment properties.

Online Platforms That Specialize In Distressed Properties

If you list the property online, you have to be strategic. While major portals get traffic, you'll find qualified buyers faster on platforms and forums that investors actually use.

Your marketing language must act as a filter. Be completely transparent with keywords that attract the right audience and save everyone time. Your listing description should include phrases like:

- "Investor special"

- "Contractor opportunity"

- "Requires full gut rehab"

This kind of honesty sets clear expectations from the first click. It signals that you're selling "as-is" and are ready for a straightforward transaction.

Auction Strategies For Time-Sensitive Sales

Need a guaranteed sale date on the calendar? A real estate auction can be an incredibly powerful tool. An auction creates a competitive, time-bound environment that forces a decision.

The winning bidder is typically required to provide a significant non-refundable deposit and close within a set timeframe, often just 30 days. This built-in urgency can dramatically speed up the entire process.

Streamlined Closing Processes That Eliminate Common Delays

The fastest way to the finish line is a cash offer. Period. Accepting cash removes the biggest hurdles in a typical sale: lender appraisals, underwriting, and financing contingencies. A cash closing can often be completed in 7 to 14 days. Compare that to the 30-60 days it takes for a sale, dependent on bank financing.

To make sure the closing is seamless, have your documents ready. This is where your earlier preparation pays off.

- A clear title

- Completed property disclosures detailing the fire damage

- All professional reports and assessments

Working with a title company and real estate agent experienced with distressed properties is key. They know how to anticipate the unique challenges and keep your sale on track.

Frequently Asked Questions

How quickly can I realistically sell my fire-damaged property in Westminster?

You might be surprised how fast this can move. When selling directly to a cash home buyer, it’s realistic to close the sale in as little as 7 to 21 days.

This speed is possible because you're sidestepping the entire traditional mortgage maze. There are no lender appraisals or lengthy underwriting processes, which typically bog things down for 30 to 60 days. The main variable is usually just how quickly a local title search can be completed.

What percentage of market value should I expect when selling as-is in Westminster?

This is the big question for most homeowners. Investors base their offers on the home's potential future value, or what we in the industry call the After Repair Value (ARV).

They use a standard formula: (ARV x 70-80%) - Estimated Repair Costs = Your Offer. What this means for you is that a final cash offer often lands between 30% to 50% of what the home was worth before the fire. If the structure is a total loss, the offer will shift to be based on land value minus demolition costs.

Do I need to make any repairs before showing the property to buyers in Westminster?

Absolutely not. The whole point of an "as-is" sale is that the buyer accepts the property in its current state, taking on the full burden of repairs and cleanup.

However, you may need to secure the property for safety by boarding up windows, as required by local ordinances. It's also crucial to know that "as-is" doesn't mean you can hide problems; state laws still require you to disclose all known defects, including the full extent of the fire damage.

How do I avoid scams when dealing with cash buyers and investors in Westminster?

Protecting yourself is paramount. Here’s a quick checklist to vet any potential buyer:

- Do Your Homework: Check for a professional website, business credentials, and reviews with the Better Business Bureau (BBB). A legitimate operation will have a verifiable track record.

- Request Proof of Funds: Ask for a recent bank statement or letter from their bank. This confirms they actually have the capital to follow through on their offer.

- Use a Neutral Third Party: Always insist on closing the transaction through a reputable title company or real estate attorney. They handle the funds and paperwork, ensuring everything is done by the book.

- Watch for Red Flags: Be wary of anyone using high-pressure tactics, asking for money up front, or refusing to put every single detail into a formal written contract.

Can I sell my property before the insurance claim is fully settled in Westminster?

Yes, you can, and it’s more common than you might think. There are generally two ways to approach this. One option is an "assignment of benefits," a legal agreement that transfers your rights to the insurance payout directly to the buyer.

The other path is to settle the claim, accept the cash payout yourself, and then sell the damaged property in Westminster at a price that reflects its current condition. The best route depends entirely on the terms of your policy and state regulations.

Conclusion

Selling a fire-damaged property in Westminster is a tough situation, but a quick, successful sale is entirely within reach. It all comes down to having a clear game plan. Here are the key steps that put you in control of the process:

- Start with a Professional Assessment: This is non-negotiable. It gives you a realistic "as-is" value to work from and informs your next move.

- Choose Your Path: You can either manage the repairs yourself for a potentially higher market price or sell directly to a cash buyer for maximum speed and simplicity.

- Tap Into a Cash Offer: The fastest route is almost always a direct sale to an investor. This bypasses the weeks of delays from traditional bank financing and appraisals.

- Price Strategically: Use the After Repair Value (ARV) to inform your pricing and negotiations, ensuring you get a fair deal for the property's potential.

- Disclose Everything: Complete transparency about the damage protects you legally and builds essential trust with your buyer.

Ultimately, you have options, each with a different balance of speed and potential profit. While this is undoubtedly a challenging time, you are no longer proceeding through it blindly. You now have the knowledge to make the best decision for your situation and move forward with confidence.

GET A FREE CASH OFFER NOW!

Free Offer Form

States We Buy Houses With Fire Damage

Sell Fire Damage House in California

Sell Fire Damaged House in Ohio

Sell Fire Damaged House In North Carolina

Sell Fire Damaged House In Michigan

Sell Fire Damaged House In Massachusetts

Sell Fire Damaged House In Colorado

Sell Fire Damaged House In Minnesota

Sell Fire Damaged House In South Carolina

Sell Fire Damaged House In Alabama

Sell Fire Damaged House In Louisiana

Sell Fire Damaged House In New Hampshire

Sell Fire Damaged House In Maine

Sell Fire Damage House in Texas

Sell Fire Damaged House in Florida

Sell Fire Damaged House In New Jersey

Sell Fire Damaged House In Virginia

Sell Fire Damaged House In Indiana

Sell Fire Damaged House In Kentucky

Sell Fire Damaged House In Oregon

Sell Fire Damaged House In Oklahoma

Sell Fire Damaged House In Connecticut

Sell Fire Damaged House In Utah

Sell Fire Damaged House In Rhode Island

Sell Fire Damaged House In Delaware

Sell Fire Damaged House in Pennsylvania

Sell Fire Damaged House in New York

Sell Fire Damaged House In Washington

Sell Fire Damaged House In Arizona

Sell Fire Damaged House In Missouri

Sell Fire Damaged House In Nevada

Sell Fire Damaged House In Iowa

Sell Fire Damaged House In Arkansas

Sell Fire Damaged House In Mississippi

Sell Fire Damaged House In Kansas

Sell Fire Damaged House In North Dakota

Sell Fire Damaged House In Alaska

Sell Fire Damaged House in Georgia

Sell Fire Damaged House in Illinois

Sell Fire Damaged House In Tennessee

Sell Fire Damaged House In Maryland

Sell Fire Damaged House In Wisconsin

Sell Fire Damaged House In New Mexico

Sell Fire Damaged House In Idaho

Sell Fire Damaged House In Nebraska

Sell Fire Damaged House In West Virginia

Sell Fire Damaged House In Hawaii

Sell Fire Damaged House In Vermont